Core: Inflation

I am struggling with a topic to write about this week. My team spent most of the week scrambling to prepare presentations on rising inflation concerns. Frankly, the ones who gave the presentations and wrote the articles are much smarter than I am. This makes me feel a little out of place in the subject matter, even though I did a lot of research on the topic.

But – saying all that – I committed to writing something every week on the things I was learning and this week I learned the most about inflation.

I will preface this whole piece by apologizing in advance for the number of unanswered questions that I pose today. Someday I hope to answer them all. But, today is not that day.

I am curious thinking about the idea of inflation and its benefits. Are there benefits? Is inflation better or worse than deflation?

A lot of smart people, and the market, seem to think that a little bit of inflation is a good thing. Let’s define a few things and then try to think through this question.

What is inflation?

As simply as I can put it – inflation is the increasing cost of the things you buy every day. If we look at the price of bread today vs a year ago, the difference (if it is positive) is considered “inflation”. Why does the price rise? It could be many factors. Consumers could be demanding more bread, driving up the price of bread. It could also be that suppliers are unable to produce bread at the same cost as before, for whatever reason, so they need to increase sale prices because their production costs have gone up.

There are a few key metrics for measuring inflation, but the most common and the most quoted in the news is the Consumer Price Index (CPI). This is a basket of goods and services that is measured monthly to help us determine the overall price change.

It has 8 major categories, but these include hundreds of different things that we purchase on a regular basis. Everything from energy costs to food to apparel, transportation, and more. Here is a broad list, courtesy of FactSet:

Is Inflation good?

This is not a question I can answer. But it is a question that I feel is worth considering and thinking about.

If we think about this broadly – the fact that the $100 you had in your bank account this time last year can only buy you $93 worth of goods and services today sounds like a bad thing. It’s hard to imagine a world where, as a consumer, paying more for something would be a good thing.

Let’s think about the other areas where inflation comes into effect though.

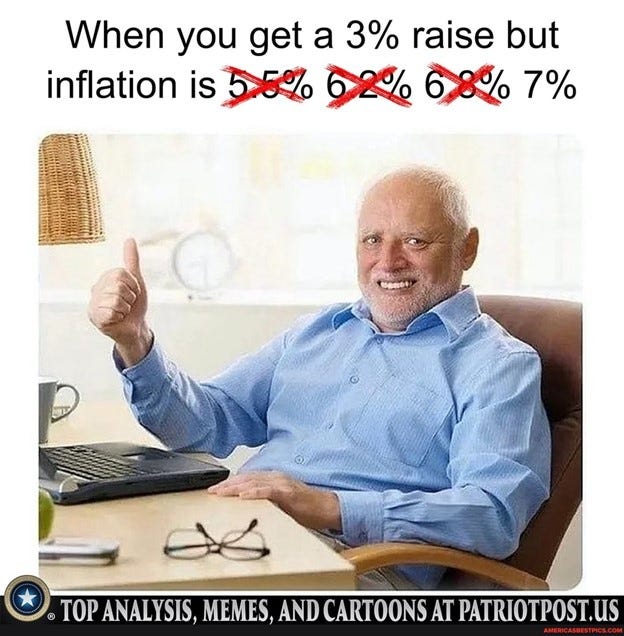

Most companies will evaluate raises based on the rate of inflation. While it used to be a common thing that you would get an inflation-based raise of 3% or something – nowadays that number could be much higher. This doesn’t mean inflation is a good thing, but it could mean that at least your level of pay might keep up with inflation.

The other argument is that price increases are positive for the economy because it increases the level of Gross Domestic Product (GDP). The number we use to judge how well our economy/country is growing. As GDP increases, it means that our economy is healthy and growing. We still have to pay higher prices, but theoretically, our pay is also increasing therefore we are less impacted. At least consciously impacted.

Experts and markets seem to believe that a moderate amount of inflation is a good thing. When I say “markets” I mean the stock market, as evidenced by positive performance numbers. See the chart below, which shows that there is positive stock performance when inflation is between 0% and 6%.

Broadly, this just shows us that based on the last 50 years of market performance – when inflation is above 0% and below 6%, both equities and fixed income securities will perform positively.

In my opinion, this ties into the thought process that a growing economy (and rising prices) is a good thing. Markets take inflation as a measure that the economy is growing and therefore generating positive returns.

They just don’t want to see inflation running too high – that causes concern.

What about Deflation?

Deflation is the opposite of inflation, instead of prices increasing over time, they are decreasing. Based on what we have said so far, this should make you think that markets will not like it (they don’t; see chart above) and it would mean that the economy was not growing.

What about Moore’s Law?

Moore's Law states that the number of transistors on a microchip doubles about every two years, though the cost of computers is halved

(Thanks, Investopedia).

Put simply, technology innovation is increasing and improving rapidly while the cost of such innovation is going down.

This sounds like an inherently good thing to me. I don’t have the exact statistical figures on this, but anecdotally I remember that a few years back an iPhone with 127GB was the top-of-the-line model and cost more than the rest. Now, 127GB is the standard size, or maybe the second tier, for iPhones without being the most expensive version.

(This example does not hold much water as the price of an iPhone has increased… a lot over the last few years).

Technology is amazing and has improved our lives immensely, yet the cost of these incredible innovations continues to go down. That is a wonderful thing. Is that deflation?

The argument that deflation is bad seems to focus on the idea that if prices are falling, consumers will wait to make purchases until the price reaches some arbitrary striking point. But if they keep falling – when is the right time to buy?

If consumers hold off on making purchases, this will lead to slow, maybe negative, growth of the economy. Since the economy is driven by the buying and selling of goods and services.

But is holding off on making purchases an inherently bad thing? If we need to borrow money (i.e. use a credit card) to make a purchase, wouldn’t it be smarter for us to wait until we had the cash on hand to make that purchase? Instead of borrowing from our future selves to appease our impatience today?

We are getting long on this one and I would prefer not to spiral down a never-ending list of questions…

For now – I’ll quit while I am ahead. But know that I am thinking about all these things and trying to understand them better.

Thanks for sticking with me!

-Jeff